owner draw vs retained earnings

In the table above retained earnings shows as a negative. Debit equity 50 for each partner and credit RE.

Negative Retained Earnings Accounting Services

One of the main differences between paying yourself a salary and taking an owners draw is the tax implications.

. Owners equity represents the business owners share of the company. Owners Draws 50000 Total Closing Owners Equity. On the other hand retained earnings represents the accumulated profits and losses of the entity.

Owners draws can be scheduled at regular intervals or taken only when needed. Retained Earnings is generally profit that gets plowed back into the. The owners loan will be adjusted against dividends or distributions when available.

Owners Draw Taxes. An owners draw also known as a draw is when the business owner takes money out of the business for personal use. Then you roll up retained earnings RE again with a journal entry.

The individual owners equity of one another is appeared in a capital record under the class of owners equity1. Partners utilize the expression accomplices equity and enterprises use Retained. An owners draw is an amount of money taken out from a sole proprietorship partnership limited liability company LLC or S corporation by the owner for their personal use.

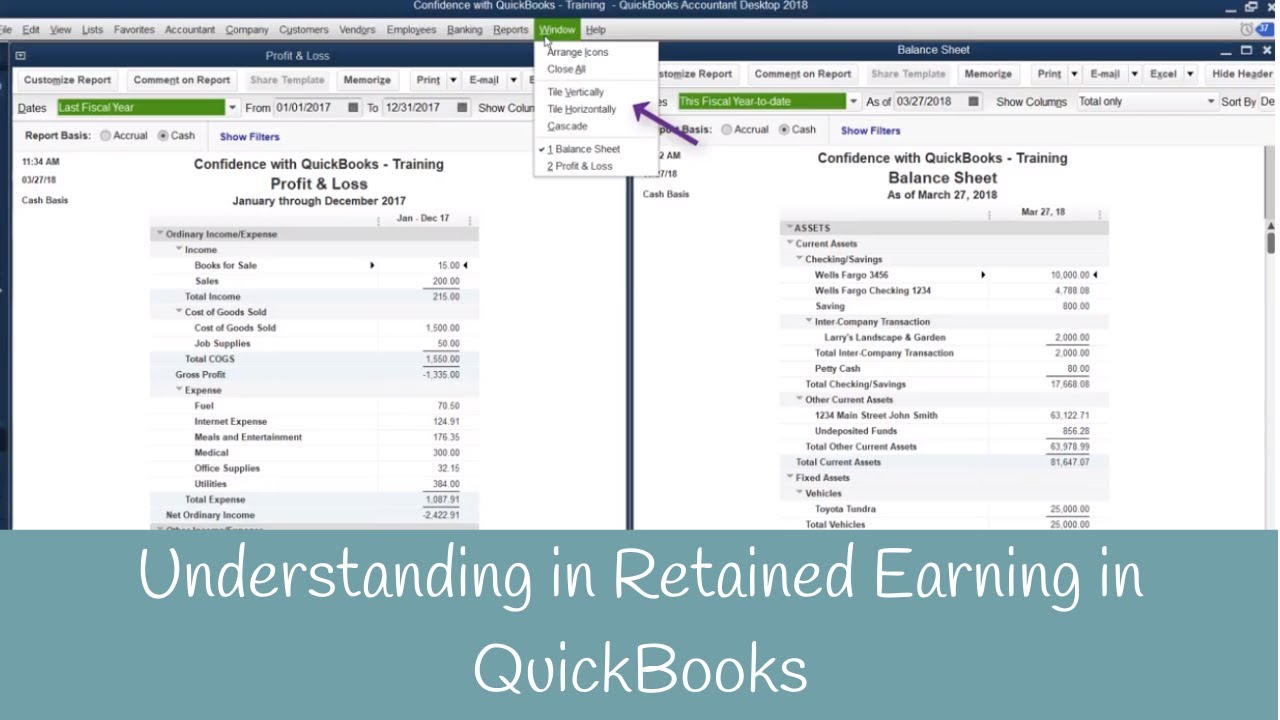

Debit RE and credit equity 50 for each partner for a loss. Retained earnings is where profits and losses get closed to at the end of the year. Similarly what is owners draw vs owners equity in Quickbooks.

If it is a proprietorship than it might be called owners capital rather than retained earnings but owners contribution is specifically for direct. So during the year you look at overall equity. The owners loan will be adjusted against dividends or distributions when available.

The best practice is to close opening balance equity accounts off to retained earnings or owners equity accounts. Updated on July 30 2020. Often directors and owners draw more funds than accumulated retained earnings hence the equity.

Opening Balance Equity This account gets posted to when you create a new chart of account for a loan or item that you enter a opening balance for in the set up of the account in QuickBooks. Small business owners should learn about the circumstances under which they. The owners can retain.

Owners Draw however is the account from which the owner takes his salary commissions fees and any other income. It creates a negative drawings impact on the business. This account should be closed out to retained earnings and not carry a balance.

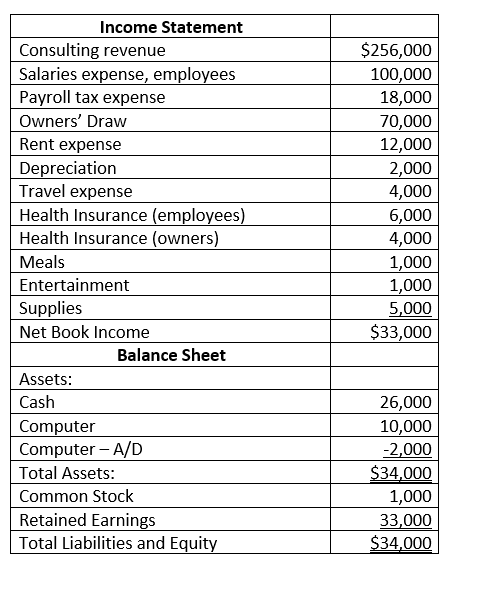

Its a way for them to pay themselves instead of taking a salary. The business would record such overcompensations as directors or owners loans. The above picture is from data in QuickBooks Online.

All business types sole ownerships organizations and companies utilize owners equity however just sole ownerships name the asset report account owners equity. The owners draw or distribution account is a contra-liability account that reduces equity. Debit equity and credit drawing.

Personal funds the owner used to start up and operate the business and continues to contribute to it are kept in the Owners Capital account along with retained earnings from operations. Recording owners draws To record owners draws go to your balance sheets Owners Equity Account and debit your Owners Draw Account while crediting your Cash Account. Retained earnings is the amount of net profit or loss a company has accumulated since its inception.

In this context itd likely be the open balance equity account. Credit Owners Draw Debit Owners Equity ie zero out draws and move to Owners Equity. There are two journal entries for owners drawing account.

Retained earnings is the amount of net profit or loss a company has accumulated since its inception. Owners Contributions is the account similar to common stock used to represent a direct investment by the owner not accumulated earnings. It can decrease if the owner takes money out of the business by taking a draw for example.

If Charlie takes out 100000 worth of an owners draw he runs the risk of not being able to pay employees. The balance of this account will now temporarily be 100 to match. The draw decreases the owners capital record and owners equity so.

Owner S Draws A Complete Guide To Owner Drawings Financetuts

:max_bytes(150000):strip_icc()/BOA-f8957c5ee9c14788b59a7e5edd802a7b.jpg)

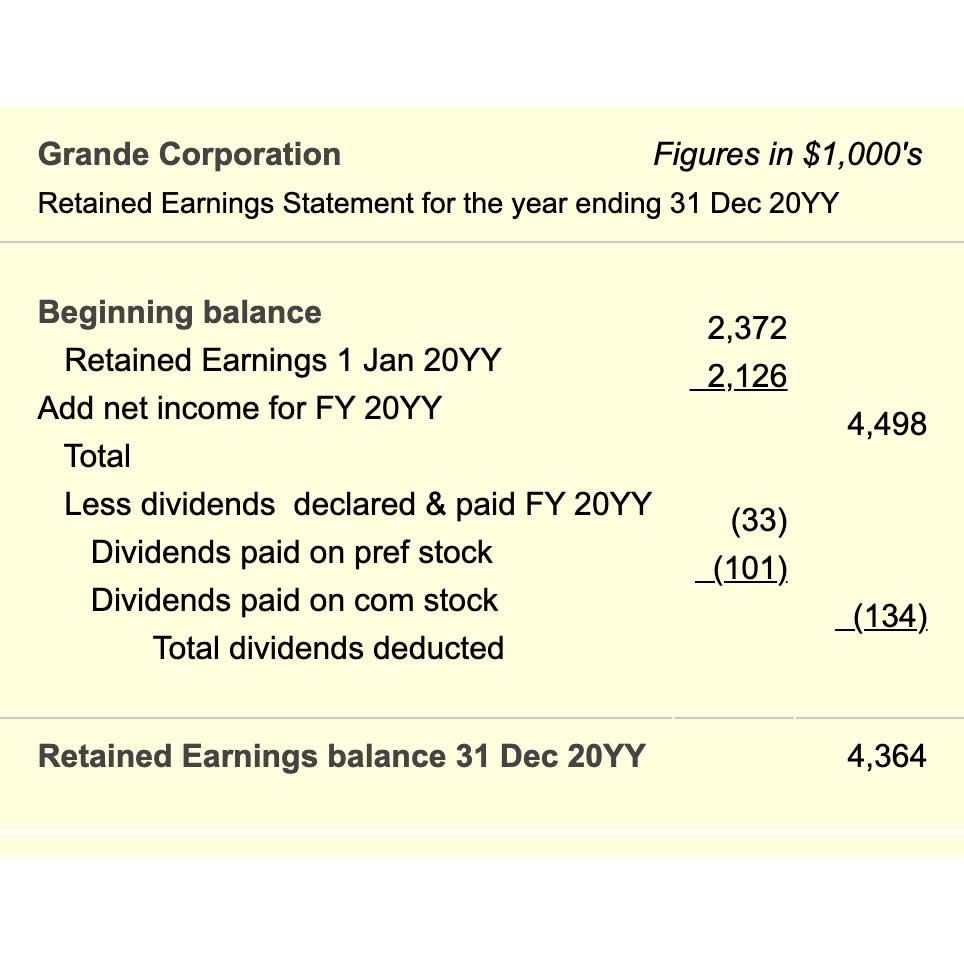

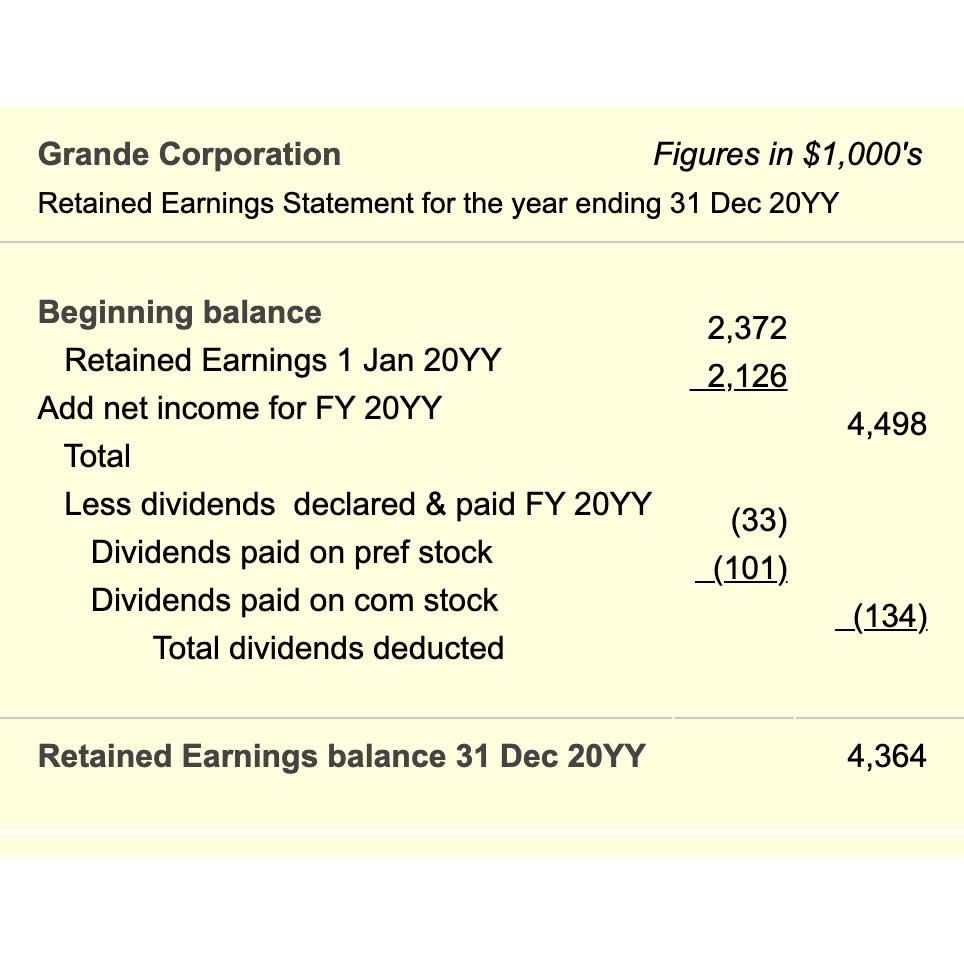

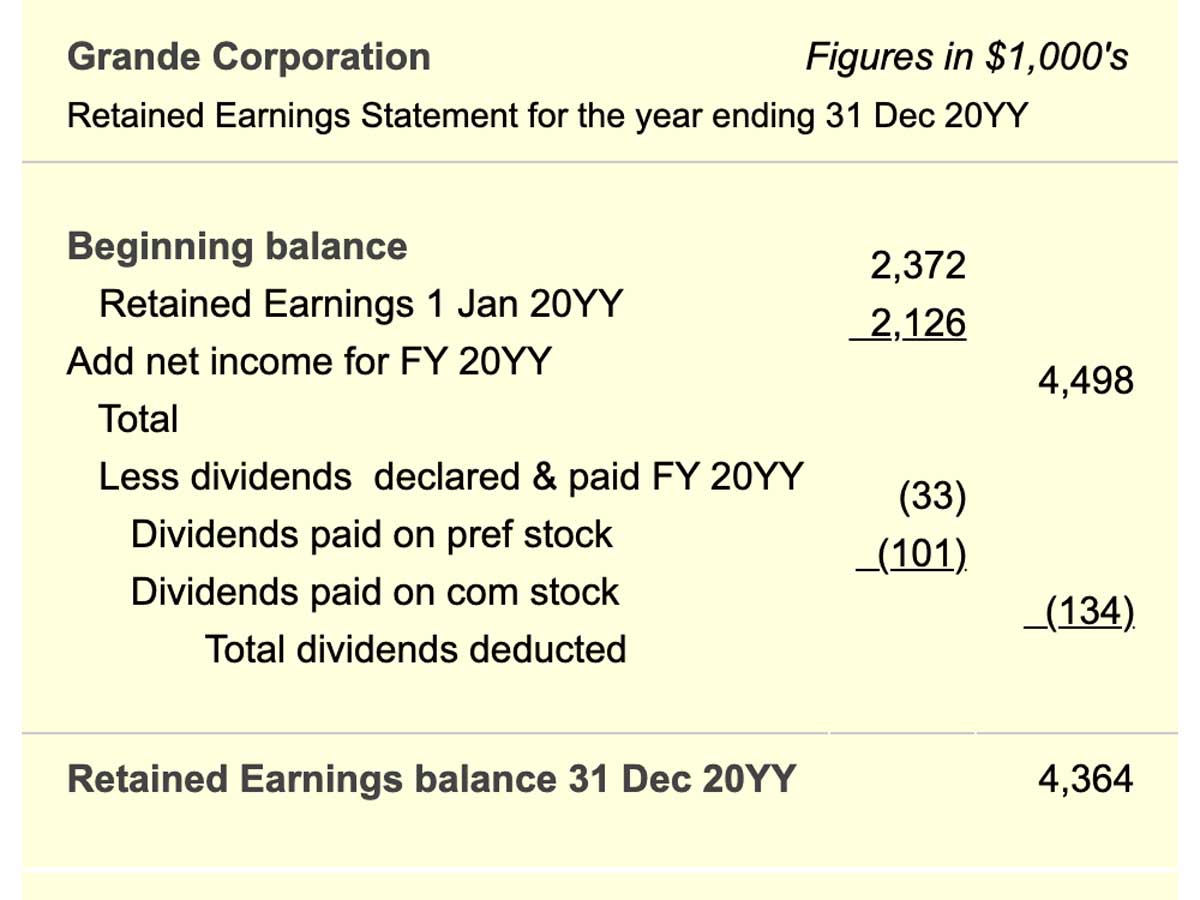

Which Transactions Affect Retained Earnings

Statement Of Retained Earnings Reveals Distribution Of Earnings Business Questions Company Financials Earnings

What Are Retained Earnings Guide Formula And Examples

Retained Earnings The Link Between Balance Sheet And Income Statement Crash Course In Accounting And Financial Statement Analysis Second Edition Book

Understanding Retained Earnings In Quickbooks Youtube

Solved Am I Entering Owner S Draw Correctly

Solved How To Close Out Owner S Draw And Owner S Investment For A Sole Proprietorship

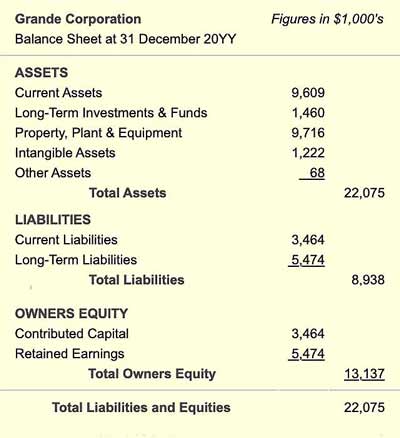

Owners Equity Net Worth And Balance Sheet Book Value Explained

Owners Equity Net Worth And Balance Sheet Book Value Explained

Things That Affect Retained Earnings Youtube

Closing Equity Into Retained Earnings In Quickbooks Online Youtube

Accumulated Other Comprehensive Income And Treasury Stock Accountingcoach

What Is The Difference Between Net Profit And Consolidated Net Profit Quora

What Are Retained Earnings Bdc Ca

Owners Equity Net Worth And Balance Sheet Book Value Explained

Quickbooks Owner Draws Contributions Youtube

Attached Are The Balance Sheet And Income Statement Chegg Com

:max_bytes(150000):strip_icc()/balancesheet.asp-Final-d803d4cbbabf4a1e8e1d18525ba6f85d.png)